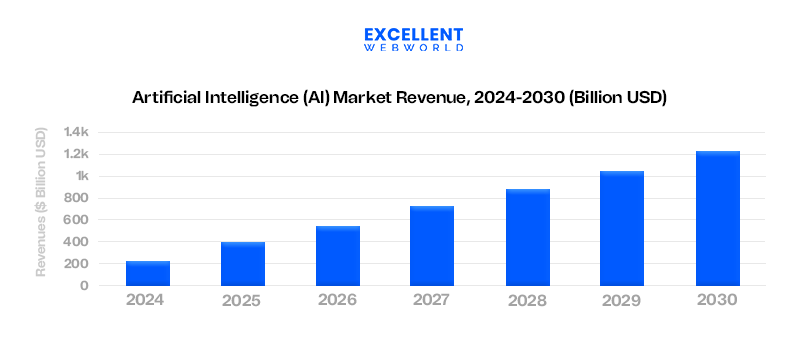

AI-powered budgeting apps like Cleo are revolutionizing how millions of people manage their finances. With over 3 million users benefiting from AI-driven financial insights, the market is set to surge. Experts predict the global AI-based finance market will surge at a remarkable 30.06% compound annual growth rate, signaling a tremendous opportunity for FinTech business owners.

However, transforming AI-based finance app concepts into reality involves significant financial considerations. Developing an advanced AI finance app can cost 20,000 to over 300,000 USD, depending on technological complexity, security requirements, and integration capabilities.

AI app development cost can go beyond initial development, including regulatory compliance and continuous updates. This article discusses the key factors that affect the average cost of creating an app like Cleo, the hidden costs associated with it, and strategic approaches to reduce additional expenses.

So, whether you’re an established fintech innovator or an enterprise trying to understand AI app development cost, this is your ultimate resource.

Detailed AI App Development Cost Breakdown

Here’s a breakdown of the steps to build a financial management app, from simple to advanced, including the AI development cost and time.

Here are the points that affect the AI app development cost:

| App Type | Cost (USD) | Development Time | Features |

|---|---|---|---|

| Simple App | 20,000 – 40,000 USD | 3-6 Months |

|

| Medium App | 40,000 – 300,000 USD | 6-9 Months |

|

| Advanced App | 300,000+ USD | 9 Months+ |

|

Estimated Development Costs Based on Complexity

| App Complexity | Cost Range | Development Time | Key Features |

|---|---|---|---|

| Simple | 20,000 – 40,000 USD | 3-6 Months | Basic UI, Single API Integration, Basic Budgeting |

| Medium | 40,000 – 300,000 USD | 6-9 Months | Interactive UI, Multiple API Integrations, Basic AI |

| Advanced | 300,000+ USD | 9 Months+ | Advanced UI, Robust AI Integration, Custom Reports |

Factors Influencing AI App Development Costs

AI in app development has several factors that affect the costs of the app. Some of the factors are hidden and influence the AI app development cost with a good margin. Here are the factors that you should consider:

All these elements together shape the overall budgeting strategy. For example, when businesses plan to integrate conversational features, evaluating the AI chatbot development cost gives them a clearer idea of how specific AI functions may influence the total app development budget.

Development Steps That Affect the Cost Of a Cleo-Like App

Creating an app like Cleo requires a strategic approach, various technologies, user-centric design, and security, which affect the overall cost. This comprehensive guide will help you understand how the development process influences the AI software development cost.

1. Market Research and Competitor Analysis

Market research and competitor analysis will help you plan the development and understand how it affects overall costs.

Here’s how these factors can influence the budget:

However, to develop a Cleo-like app, you must understand the unique features that make Cleo stand out.

Let’s explore the core features that meet the requirements and influence the AI app development cost of building a fintech app like Cleo.

2. Define Core Features

Building fintech apps like Cleo stands out from the competition because of its unique features. You can choose features according to user needs and pain points, required core functionality, and finance tool requirements. Additionally, you can choose AI Consulting for better clarity.

Let’s look at some of the features you need to develop your AI fintech app.

| Core Features That Affect Cost | Description |

|---|---|

| Balance checks | Checking the current balance in real time and tracking your finances involves secure integration with banking APIs or financial institutions, which can increase the overall cost. |

| Sign-up/sign-in | Registration and login options are available to access your account securely. Adding features like social media logins or passwordless authentication makes the app complex and costly. |

| Create a budget | A personalized budget according to the income and spending goals. Categorization and personalization will affect the AI app development cost. |

| Spend tracker | Track and categorize your expenses automatically for better financial management. This is closely related to budget creation but requires a more detailed categorization of transactions and continuous syncing with bank accounts, making the development more complex and costly. |

| Push notifications | Real-time alerts about all transactions and account activities. This requires additional infrastructure, such as Firebase or other services with AI personalization, which increases complexity and AI development cost. |

| AI functionalities | Using AI for analysis and predictions. AI functionalities require ML algorithms, data modeling, and often large datasets for training models. This increases the costs of development and time. |

| 2-factor authentication | Added two layers of security to ensure safe logins and user data. This requires additional infrastructure, especially if the system needs to support multiple 2-factor methods or integrate with existing authentication systems, directly affecting AI app development cost. |

| Advanced Features That Affect Cost | Description |

| AI-based advisor to spend | A smart advisor provides a personalized AI strategy and spends according to financial habits. Integrating machine learning to analyze user behavior and goals increases the AI development cost. |

| Setting budget limits | Allow users to set limits category-wise. Integrate AI to enhance automatic suggestions and realistic budget limits based on past spending behavior, income, and financial goals that affect the cost. |

| Spending habits report | Provide detailed insights on spending patterns. Presenting these insights in an easy-to-understand format through charts, graphs, or recommendations involves extra design and cost. |

| Personalization | Customization features and personalized advice for financial goals. It requires complex AI algorithms and machine learning models to analyze user data and behavior. Also, more data storage is needed. which increases ongoing maintenance costs. |

| Impart financial literacy | Informational tools and content to improve user knowledge about personal finance management. |

3. Choose a Fintech App Development Platform

The platform can significantly impact AI app development costs, as each platform uses a different tech stack for development. You have multiple options to develop an app for iOS and Android platforms, such as native apps or hybrid apps.

Native apps are built specifically for one platform, such as iOS or Android. They require native programming languages like Swift for iOS and Kotlin for Android. The native approach provides high performance and security. It’s a good option for a finance app as it allows for high security, but building multiple codebases and testing for different platforms increases the AI app development cost.

On the other hand, hybrid apps use a single code base for iOS and Android, requiring web development languages such as React Native or Flutter. Hybrids allow for fast development and reduce the significant AI development cost.

4. Design a User-Friendly Interface

Focus on visual elements like buttons, input fields, and menus. Additionally, intuitive navigation will improve the customer experience with finance application design. It’s quite challenging to create a navigable, simple yet attractive design, which requires professional experience with designing and tool costs.

However, you can hire a designer to control the cost of design. Here are some points to consider when managing design costs.

5. Develop AI Capabilities

AI capabilities must be built while developing an app like Cleo. Train your chatbot to resolve user queries and respond in a human tone. For that, you can use frameworks like Dialogflow or Rasa. These frameworks change the complex artificial intelligence support to understandable language for users.

You can build an AI model to analyze user data and provide forecasts like spending advisors. To create an AI model, you need to follow these steps.

Developing AI capabilities for an app like Cleo significantly impacts costs due to the need for specialized expertise, advanced algorithms, and resources. Ongoing monitoring and refinement add long-term maintenance costs.

6. Ensure Data Security

Financial apps handle sensitive user data, so you must prioritize security while developing. User data should be protected through end-to-end encryption. This encryption can be used for the storage and transmission of data. Implement secure login methods like two-factor authentication (2FA) or biometric verification (e.g., fingerprint or facial recognition).

Advanced encryption, secure login methods, and compliance with regulations add additional costs for integration and maintenance. These security measures require specialized expertise and resources that increase ongoing expenses. However, they are crucial for protecting user data and maintaining trust, making the investment necessary for financial app development.

7. Cost of Integrating Third-Party APIs

Third-party APIs allow for features like payment gateways, geolocation, or social media integration. Additionally, they can significantly enhance your app’s functionality without requiring extensive development. These integrations and ongoing maintenance of functionalities impact the overall AI app development cost of your finance management.

However, you need API development according to the complexity of the application.

API development.

8. Test & Launch

Without performing testing, an AI-driven finance app risks losing credibility, failing regulatory audits, and exposing users to financial risks. Testing also ensures data accuracy, security, and a seamless user experience.

Testing can be completed using multiple types of testing for a better user experience.

The time and resources required for multiple testing phases impact the AI app development cost. Post-launch updates also influence the budget.

Strategies to Optimize Development Costs

Building an AI app can be expensive, but smart choices can save money. Focus on the essentials, use pre-built AI models instead of creating everything from scratch, and choose cloud solutions wisely. Hiring the right team also impacts the cost of implementing AI.

If you want to save even more? Think long-term. Invest in scalable tech and efficient workflows to prevent unnecessary spending.

1. Prioritize Core AI Features

Focus on MVP (Minimum Viable Product), a basic version with only the most valuable features. Let users try it, gather feedback, and improve from there. This way, you avoid burning money on features that might not even click with your audience.

2. Choose a Flexible Tech Stack

Use low-code or no-code tools along with plugins. These speed up development, making the process smoother and more efficient. A flexible tech stack also helps avoid compatibility headaches across different platforms, keeping AI projects on track and preventing costly delays.

3. Fine-Tune Pre-Trained AI Models

Small and mid-sized businesses (SMBs) often use pre-trained AI model methods. These methods are cost-effective and still deliver AI that feels custom-made. Thus, you can save money while ensuring the AI works perfectly for your needs.

4. Agile Methodology Implementation

Through the agile approach, you can reduce the cost significantly as agile improves efficiency and project outcomes. Here are some key benefits of using agile.

5. Use Cloud-Based AI Platforms

You can skip the hassle of maintaining servers and handling security, saving a lot of money in the long run. Innovative, scalable, and cost-effective

6. Leveraging Open-Source Solutions

Using open-source technologies can dramatically reduce the cost of implementing AI while providing robust, community-supported solutions. Here are some points that you should consider:

7. Outsource to AI Developers

Hiring an AI developer isn’t just about their salary—you’ll also pay for equipment, software licenses, infrastructure, training, and perks. All of this adds up fast! Well, it’s hard to choose whether you should go for outsourcing or in-house development. If you lack in-house expertise, have tight deadlines, a limited budget, and require access to new technologies, you should hire an app developer.

A smarter move? Outsource to a firm that specializes in providing dedicated AI development services. They already have skilled experts and the proper setup, so you get top-quality results for less money, fewer delays, and minimal errors.

Must-Have Feature for AI app development like Cleo

When creating a financial management AI app like Cleo, it’s crucial to include features that make managing money simple, engaging, and valuable for users.

Here are some essential features to ensure your app stands out:

1. AI-Powered Chatbot

An AI-powered chatbot provides a personalized customer experience in apps like Cleo. It engages users in natural conversations and offers tailored financial advice and support. The chatbot can answer budgeting, saving, and spending questions while providing tips based on the user’s financial history.

Voice interaction, real-time advice, humor to boost engagement, and integration with other services for smooth communication.

2. Spending Analysis

This feature analyzes users’ spending habits by connecting to their bank accounts, credit cards, and other financial platforms. It automatically tracks income and expenses.

Visual reports (e.g., pie charts), expense reduction suggestions, categorized spending (e.g., food, entertainment), and trend analysis over time.

3. Budget Creation

Budgeting tools let users manage their finances by setting personalized budgets for categories like rent or groceries. The app tracks progress in real time.

Dynamic budget adjustments based on income changes, automated tracking, regular reviews, and alerts for overspending.

4. Cash Advances

Offering small, short-term loans helps users cover urgent expenses like medical bills or car repairs when they need cash. The loans have transparent terms, automatic approval based on financial standing, and an easy application process.

5. Credit Score Monitoring

This feature lets users track their credit score regularly and receive tips to improve it: regular updates, alerts for changes, personalized improvement tips, and access to detailed credit reports.

6. Savings Goals

The app allows users to set savings targets (e.g., for vacations or emergencies) and track progress over time. It also features automated savings plans, progress bars for visual tracking, and motivational notifications.

7. Expense Categorization

Automatically categorizing transactions gives users a clear view of their spending habits without manual effort. Real-time categorization, editable categories, smart suggestions based on habits, and a system that learns user preferences over time.

8. Multi-Platform Support

The app should be consistent in functionality and work seamlessly on Android and iOS. It should also synchronize data across devices, have an optimized UI for each platform, and be compatible with tablets and smartphones.

Why Build Your AI App with Excellent Webworld?

The above article should have helped you understand how to build an AI app and the cost breakdown. However, one critical aspect of this process is understanding the factors that reduce the cost of AI app development. Excellent Webworld is an experienced web development company with industry expertise.

We have over 13 years of experience providing AI app development services. Our team of experts has successfully developed high-performance fintech apps that integrate advanced AI technologies. With more than 900 successful projects, our experts have catered to different client needs in app development.

We are a leading app development company that offers end-to-end development and integration for AI practices. Contact us now to learn more about our solutions.

FAQs

AI app development costs typically range between USD 20,000 and USD 250,000+. However, this AI development cost depends on project complexity, data needs, and integration requirements.

Cleo AI, an intelligent financial companion, sustains its revenue stream predominantly through a hybrid model that blends complimentary access with premium features. This approach entices users with basic functionalities while reserving advanced financial tools behind a subscription paywall.

Investing in a money management app like Cleo can be a smart choice for anyone wanting better control over their finances. Cleo offers AI-powered tools to help users track spending, create budgets, and manage debt. It also provides personalized insights and features like cash advances of up to 500 USD.

Cleo, an AI-powered financial assistant app, works on a freemium model. It provides free basic budgeting and economic tools while charging for advanced features like cash advances, credit coaching, and cashback through its financial products’ subscription plans and transaction fees.

Article By

Mahil Jasani began his career as a developer and progressed to become the COO of Excellent Webworld. He uses his technical experience to tackle any challenge that arises in any department, be it development, management, operations, or finance.